A tale of two villages – steady SUM and a RYM reckoning

16 September 2024The post-COVID era has been incredibly difficult for many. In the context of NZ equities, perhaps none more so than the retirement village (RV) sector which has been stung by both higher interest rates and a weaker housing market. Ryman Healthcare (NZX:RYM), once the flag-bearer for the listed RV sector in NZ is down ~50% since 31-Mar-20. For comparison, Summerset Holdings (NZX:SUM) is up over ~100%. In terms of our funds, we have fortunately been on the right side of this equation. Our process was instrumental to us making the right stock call.

To set the stage, our investment process consists of three key ingredients, being our quantitative, qualitative and valuation assessments. The detailed work we did on each of these led us to a clear conclusion on which was the better business.

Quantitative assessment:

Mint’s investment process incorporates a quantitative model which scores stocks on key proprietary factors (e.g. balance sheet, earnings, valuation) and rank them accordingly within a given universe. Effectively, it helps us to select stocks with statistical profiles that have tended to perform well historically and avoid those which have tended to perform poorly. Quantitative models like this are widely used by many successful asset managers. Our methods have been developed using over 30 years of rigorous testing of global developed markets, including New Zealand. In this instance, the model proved prescient – over the period in question, the average score for SUM was 80, while the average score for RYM was 35.[1]

Qualitative assessment:

At Mint, we believe combining Quantitative data with Qualitative analysis is the best way to garner effective results. Key tenets of our qualitative assessment are company earnings, balance sheet strength, management ability, and environmental, social and governance (ESG) risks. (Some of these categories may appear to repeat those from the quantitative assessment, but the two approaches are actually analysing different perspectives on the same broad attributes).

First, the balance sheet.

A critical component of the value of retirement villages is recovering the capital spent on developing new villages by selling units in those villages and recycling that capital into development of the next village(s). If a new village does not recover its development costs,[2] the debt used to develop that village will remain on the balance sheet and need to be repaid out of the earnings of the existing portfolio of villages – far from ideal!

According to our analysis, SUM had a good record of efficiently recycling its capital from developments, while RYM had performed relatively poorly in this regard. The factors influencing this include the scale and style of the villages. SUM's choice to develop mostly single-story villas allowed for quicker capital recovery and reduced debt exposure, while RYM's larger, more complex apartment-style developments tied up more capital and contributed to its growing debt burden.

Though there were other sins,[3] this was the primary reason RYM had built its crippling debt position. For context, most debt-heavy companies in the NZX50 say their “comfortable” gearing range is ~30-35%.[4] RYM’s had been exceeding 40%. That might have been sustainable when the OCR was below 2%. But when interest rates doubled and property prices fell off their dizzying perch in late 2022, RYM’s lenders got queasy, forcing the company to raise $900m to pay off its debt. After taking this medicine, RYM’s management introduced a 30-35% target gearing range.

In contrast, SUM’s balance sheet was a lot healthier, with the core business unburdened by non-development debt. As it entered this post-COVID era, its gearing was below ~28%.

Examples of different developments. Summerset Monterey Park (left) has more villas which are quicker to build and sell as opposed to larger apartment type developments like Ryman Bert Sutcliffe (right). It is important to note that both companies operate a range of different developments, these are merely examples of typical structures.

Now to earnings quality. While this didn’t ultimately end up biting RYM as hard as some other issues, it was emblematic of the differences between the companies over this period.

SUM reports revenue from unit sales when it receives the cash for the sale. Up until its FY24 results, RYM reported sales when they were “booked”. Essentially, they were counting a sale before the cash came in the door. That practice is inherent to accrual accounting, but reporting it in this way creates risk that sales won’t turn into cash and the sale needs to be reversed on the company’s books.[5] We want our clients to get paid to take risk, so we factor this quality of earnings into our evaluation of a company.

And finally, governance. Governance is a complex and often subjective area, but one of the more tangible aspects is the transparency of management incentives. Taking one overlapping period in 2022,[6] the disparity in disclosure relating to how the respective management teams were incentivised against short term performance is stark.

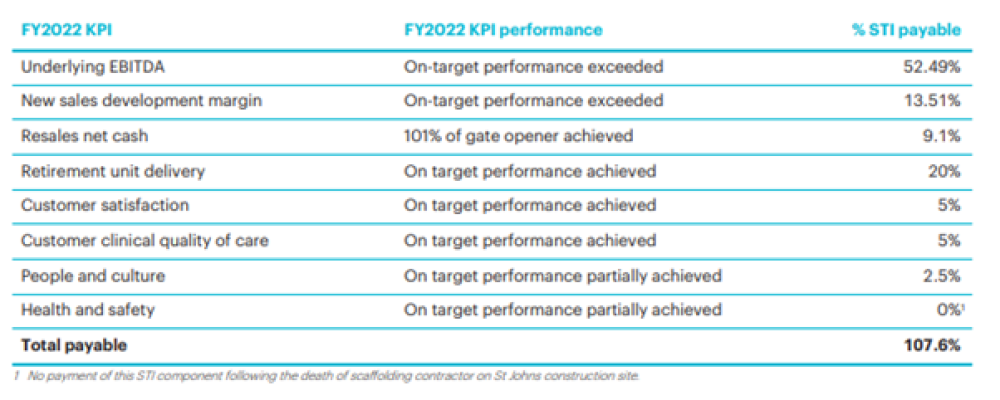

First, SUM present this table demonstrating the make-up of short-term incentive (STI) payments to the CEO:

The table provides a breakdown of known, if imperfect in our view, measures of business performance.

By comparison, RYM provides the following sentences in its 2022 Annual Report, which does the same job as the above table does for SUM:

“The payment of short-term and medium-term incentives depends on achievement of certain results and outcomes. Performance over the 1-year and 3-year periods is measured against stretch performance targets. The performance metrics differ with each role”. (Emphasis added).

As my comment on this juxtaposition, I offer a twist on one of the late Charlie Munger’s favourite aphorisms: show me the incentive and I’ll decide whether I like the outcome.[7] Based on SUM’s disclosure, I can make a pretty accurate assessment of whether I like what management is going to serve up. But with RYM, with its “certain results and outcomes”, ironically, the investor isn’t being shown anything.

This was one of many issues informing our appraisal of the two companies’ governance. Good governance includes establishing effective guardrails for management. This can manifest as “comfortable gearing ranges” and how financial results are reported. At RYM, there was a clear absence of such oversight. ‘Good’ governance can be subjective, but a start is at least showing investors something to base their opinion on.

Valuation

As a result of our above estimation of the relative capital efficiency of the two companies’ build programmes, we had materially diverging expectations for their future build rates.[8] While we believed SUM would be able to continue to grow the number of units it built each year for some time, our analysis of its capital efficiency and debt load suggested that RYM would need to level off or reduce its build rate. That expectation, and the likely corrective action RYM would have to take to repair its balance sheet, had a meaningful impact on our assessment of the value the two companies would deliver in terms of future cash flow per share.[9] Crucially, we did not think these factors were reflected in the companies’ share prices.

Conclusion

The retirement village sector was at the pointy edge of some of the challenges the economy has faced in the post-COVID period. Put simply, a weak housing market is not a conducive environment to selling retirement village units. For good (SUM) and for ill (RYM), this pressure brought to the fore some of the eminent business features and risks identified in our investment process and resulted in quite differing fortunes for the two companies over these last few years. Thankfully, we were positioned to take advantage for our funds. By sticking to our disciplined approach, we hope to be able to be in that position again and again.

[1] Scores are presented on a 0-100 scale.

[2] Inclusive of non-cash generating village communal facilities.

[3] Overpaying its dividend being one, though not as material a differentiator, between the two companies.

[4] Gearing refers to how much debt a company has used to fund its business.

[5] For example, if revenue is reported relating to an incoming resident before the company receives the cash settlement, there is always a chance that the incoming resident reneges, and that revenue recognition must be unwound.

[6] RYM and SUM have different financial year ends which makes comparing identical periods impractical.

[7] The real quote is “show me the incentive and I’ll show you the outcome”.

[8] I.e. the number of units and / or villages they would be able to complete each year.

[9] We favour a DCF approach to valuation. See my previous article.

Disclaimer: Sam Arcand is an Investment Analyst at Mint Asset Management Limited. The above article is intended to provide information and does not purport to give investment advice.

Mint Asset Management is the issuer of the Mint Asset Management Funds. Download a copy of the product disclosure statement here.